Actualités

Stocks end the year in record territory

International - Stock market 31.12.2013

Major stock markets are ending the year at record highs as they continue to benefit from record low interest rates in the US and Europe and a benign outlook for inflation.

The FTSE All World Index was close to ending the year on a new high. It was up 0.2 per cent at the open of trade in New York, having closed Monday’s session at 267.87, a record close. It is up nearly 20 per cent for the year – its biggest annual advance since 2009.

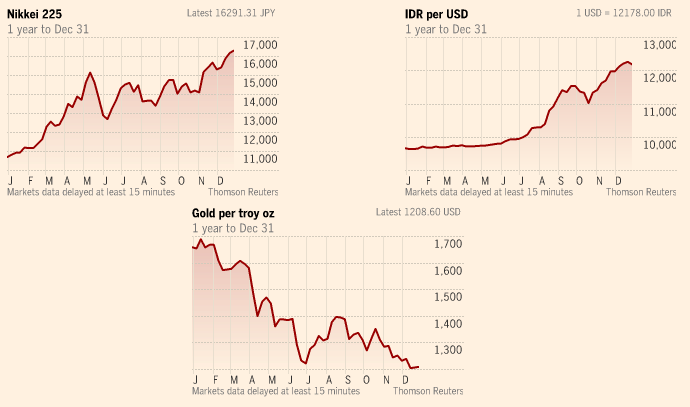

Government bond prices, meanwhile, have dropped and yields have risen as investors sought higher returns on riskier assets. Gold also suffered heavy losses, recording the biggest falls for three decades.

US markets opened the final session of 2013 at fresh record levels. The S&P 500 gained 0.2 per cent to 1,843.85 and is up 29 per cent this year, while the Dow Jones Industrial Average opened 0.1 per cent higher at 16,522.53, an annual climb of 26 per cent.

In Europe, the FTSE Eurofirst is heading for an annual gain of 16 per cent, with Germany’s Xetra Dax, which is closed today, finishing up 26 per cent higher, making it the best performer of the major European markets. London’s FTSE 100 closed up 0.3 per cent at 6,749.09, taking its gains for this year to 14.4 per cent.

Elsewhere in Europe, Bulgarian stocks were the region’s best performers this year with gains of more than 40 per cent, while Irish stocks rose 33 per cent in the year the country emerged from its international bailout.

In Asia, Japanese stocks were the standout gainers, helped by Shinzo Abe’s first year in power and his drive to combat decades of deflation with a monetary stimulus programme known as Abenomics, leading to a rapid fall in the value of the yen which helped the country’s dominant exporters.

Tokyo’s markets were shut on New Year’s eve, but Japan’s Nikkei 225 index notched up a 57 per cent gain this year – its largest annual advance in four decades – to end at a six-year high of 16,291.13. The yen is down 22 per cent over the year to Y104.93 against the dollar, making it the worst performing major currency.

Chinese stocks had tougher time, however, as reforms, including property market rules, hit some of the country’s biggest sectors. The Shanghai Composite, which climbed 0.9 per cent to 2,115.98 on Tuesday, was down 7 per cent on the year. Hong Kong’s Hang Seng index inched up only 2.9 per cent in 2013.

Among the worst performing assets this year were those of emerging markets which suffered from investors’ worries about structural imbalances and the impact of any reduction in the Federal Reserve’s asset purchases programme.

Morgan Stanley identified the “fragile five” currencies in the summer after the Federal Reserve first indicated its intention to slow its $85bn a month of bond buying.

Stock markets in Turkey and Brazil have registered falls of 18.3 per cent and 15.9 per cent respectively this year, while the Indonesian rupiah and the South African rand have fallen by more than 20 per cent against the dollar. Meanwhile the Indian rupee is down 12 per cent and the Brazilian real 15 per cent. The Turkish lira is down 18 per cent.

Among the major currencies, the euro gained on the dollar in spite of the US being the first to start removing monetary stimulus. The single currency trades at $1.3766, up 4.1 per cent on the year. Sterling is up only 2.3 per cent on the year at $1.6542.

Gold has been the standout mover on commodity markets after investors moved into higher yielding, riskier assets. With inflation also remaining anchored, the precious metal recorded its biggest annual fall since 1981. It ended the year down 29 per cent at $1,188.01 an ounce.

Government bond markets have been similarly unloved as rising confidence in economic recovery have pushed both UK Gilt and US Treasury benchmark yields above 3 per cent. The Barclays Aggregate index – the bond market benchmark – has fallen nearly 2 per cent this year, its first annual drop since 1999.

The big winners in the fixed income market have been corporate issuers, who have found the low rate environment the perfect setting for fundraising through the capital markets.

Source: FT

------------

© 2011, MENA Capital Partners tous droits réservés. Les

informations et statistiques contenues dans ce document ont été préparées par

MCP sur la base de renseignements provenant de sources considérées comme

fiables. Malgré nos efforts pour mettre à disposition des informations

précises, leur conformité et leur exactitude ne peuvent être garanties. Cette

publication est destinée à l'information des investisseurs et ne constitue pas

une offre de vente ou d'achat de titres.

Accès client

Accès client English

English